Building a New Commercial or Residential Property? Why You Need Course of Construction Insurance

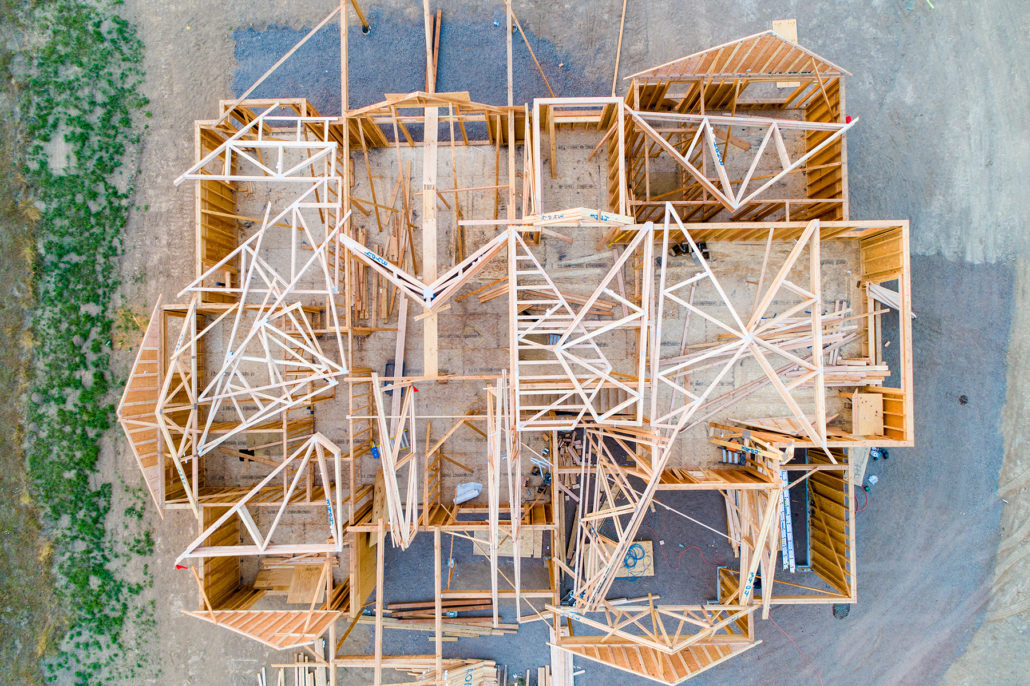

Course of Construction insurance also referred to as “Builders’ Risk”, provides coverage for buildings throughout the course of construction. And it’s required!

Imagine a construction team heads home from a residential building project on Friday afternoon. Over the course of the hot and sunny weekend, an oil-soaked rag left in a bucket in the garage ignites due to overheating and destroys all the materials as well as the house, itself.

Without proper and necessary Course of Construction (COC) Insurance, the rebuild, and replacement of materials would be entirely laid at the building contractor’s feet.

Builders’ Risk Insurance is designed to insure building projects – residential or commercial – that are under construction against the costs of replacement, rebuild, or repair in the event of an accident similar to that described above.

COC provides both the building owner or developer, as well as the general contractor, valuable protection and peace of mind.

COC protects not only the contractor, but the owner as well, from any devastating results of incidents such as floods, fires, vandalism or theft, and any other unwelcome potential accidents to a construction site. When you insure your project for the entire course of construction, you enjoy financial protection in the case of loss or damage to the materials, appliances, and fixtures that make up the completed construction.

Typically, most policies are provided on an “all-risk” basis – the amount of coverage is equivalent to the building’s finished value.

COC insurance is always purchased prior to the first steps of construction – digging and pouring the foundations.

Is my general contractor required to buy Course of Construction coverage?

Generally, a builder’s risk policy covers a number of stakeholders. A standard policy can be purchased by the owner, the general contractor, the architect, an engineer, or the project manager. However, most often, the insurance purchase is the owner’s responsibility, unless it’s identified in the building contract that it falls to another party.

Subcontractors are often fundamental to any building project. They are also included in a COC insurance policy as “unnamed insureds,” falling under the same coverage benefits regardless if the policy was purchased by the owner or the contractor.

In most cases, it’s the contractor who bears responsibility for any losses as a result of their negligence, but the project owner is usually responsible for most other damages or losses.

What are the limits of coverage?

The COC policy is designed to provide fairly broad and comprehensive coverage, however, it doesn’t necessarily cover all property connected to the building project, and nor does it cover each and every risk. It is vital that you discuss your specific needs with your insurance agent, as COC insurance is only one component in the range of insurance options that applies to the construction industry.

There is other coverage available through what is referred to as endorsements, or through other policies designed specifically to provide protection against the range of risks not included in a standard Builder’s Risk policy.

Questions about an upcoming building project and the policy that you need? We can help! Contact us today!